What Barrie Businesses Need To Know

Tariffs are often headline news, yet many businesses still find the concept unclear or disconnected from their day-to-day operations. In reality, tariffs play a crucial role in shaping market dynamics, pricing, competitiveness and supply chains. Especially in a trade-dependent region like ours, where Canada and the United States maintain one of the world’s most closely connected trading relationships.

This overview will help you understand what tariffs are, why they matter and how they affect Barrie’s business community.

What Is a Tariff?

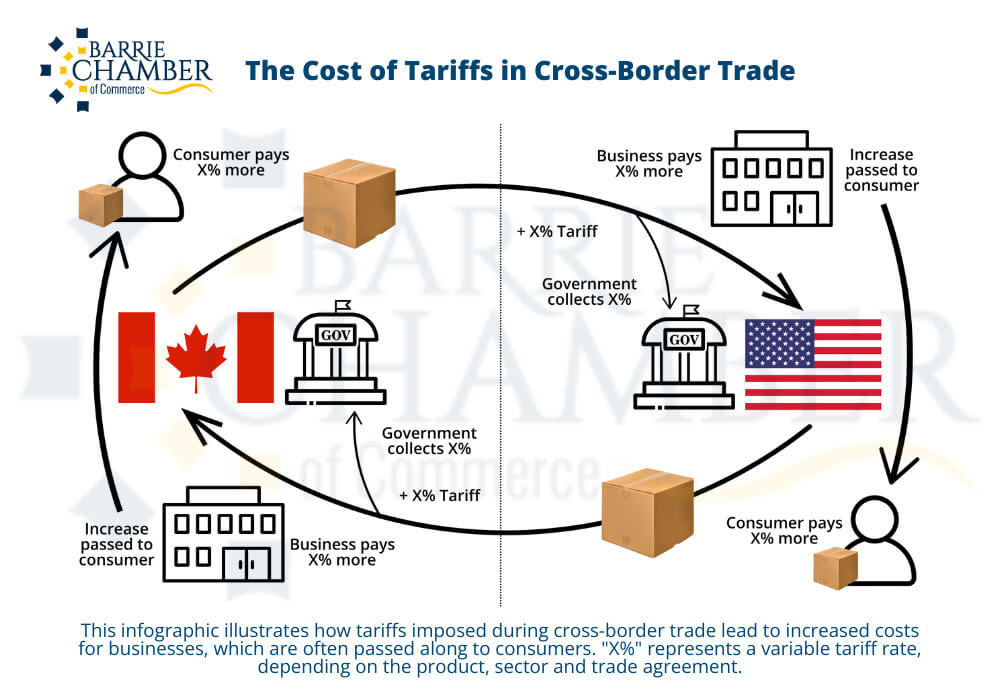

A tariff is a tax imposed by a government on imported goods and services. When a product crosses the border into Canada or the U.S., a tariff may be added to its cost, making it more expensive for buyers in the importing country. These fees are typically calculated as a percentage of the product’s value.

Why Are Tariffs Used?

Governments impose tariffs for several reasons:

- Protecting Domestic Industries: Tariffs can make foreign goods more expensive, giving local companies a price advantage.

- Generating Revenue: Tariffs create income for the government.

- Negotiating Leverage: Tariffs can be used in trade negotiations to encourage other countries to lower their own trade barriers or meet policy goals.

While tariffs can offer short-term protection to domestic industries, they often come with long-term costs - especially for businesses reliant on international supply chains.

How Tariffs Affect Your Business

Even if your business isn’t directly importing or exporting, tariffs can impact you in several ways:

- Cost of Goods

Tariffs can increase the price of raw materials, components, and finished goods. This can affect profit margins, retail pricing, and customer demand - especially if those goods are sourced from the U.S., China or other trade partners.

(For more, see: BDC – Managing supply chain disruptions) - Supply Chain Disruptions

Sudden changes in trade policy can delay shipments or lead to inventory shortages, especially in industries like manufacturing, construction and retail. - Competitiveness

Canadian companies competing with U.S. firms may face disadvantages if tariffs increase input costs here but not south of the border. Conversely, tariffs placed on U.S. goods could give local producers a competitive edge. - Increased Administration

Managing tariffs often means more paperwork, regulatory oversight, and compliance costs. Businesses may need to hire import/export specialists, consult with trade lawyers, or outsource to third-party customs brokers to ensure timely delivery and avoid complications at the border. These added administrative demands increase both workload and operational expenses, especially for small and mid-sized businesses. - Cross-Border Business

Barrie businesses with operations, partners, or customers in the U.S. may experience complications related to customs compliance, shipping delays or fluctuating costs.

Ready to find out more?

Check out our Tariff Resource Hub for more information, available programs and supports.

Canada–U.S. Trade: A Vital Partnership

Canada and the United States share the largest bilateral trading relationship in the world, with over $2 billion in goods and services crossing the border each day.

(See: Government of Canada – Canada–U.S. Relations)

(Also: Global Affairs Canada – Trade and Investment Facts)

The U.S. is Canada's largest trading partner - and Ontario, in particular, is deeply integrated with American supply chains. Tariffs on either side of the border can ripple across our economy, influencing everything from automotive parts and steel to agriculture and consumer electronics. Understanding these dynamics helps local businesses stay agile and informed.

What Can Businesses Do?

Here are a few best practices for navigating tariffs effectively:

- Audit Your Supply Chain: Identify which products are tariff-sensitive and explore alternative suppliers or materials if needed.

- Stay Informed: Keep up with trade policy updates from trusted sources like the Canada Border Services Agency (CBSA)

and Global Affairs Canada. - Build Flexibility into Contracts: Negotiate supplier agreements that allow for tariff-related price adjustments or renegotiation clauses.

- Advocate Collectively: Engage with business associations like the Barrie Chamber of Commerce to voice concerns and shape advocacy efforts related to trade policy.

Final Thoughts

Tariffs are more than just economic levers used by governments - they’re real-world factors that influence how we do business in Barrie. Whether you’re a manufacturer, retailer, wholesaler or service provider, understanding the basics of tariffs can help you manage risk, stay competitive and prepare for the road ahead.

If you’d like more information or support on how trade policies could affect your business, the Barrie Chamber of Commerce is here to help.

Ready to find out more?

Check out our Tariff Resource Hub for more information, available programs and supports.